Remember that time you were in a foreign country and needed to pay for something, but the only option was a check? You were faced with a blank piece of paper and a sense of overwhelming confusion. If you’ve ever experienced that, you know how daunting it can be to write a check in a language you’re not completely fluent in. But fear not, because writing a check in English is a skill that can be learned quickly and easily. This article will guide you through the step-by-step process, making it simple to understand and master.

Image: blog.remitly.com

From filling out the date to correctly writing the amount, this comprehensive guide will cover all the essential elements of writing a check in English. Let’s dive in and conquer the art of check writing.

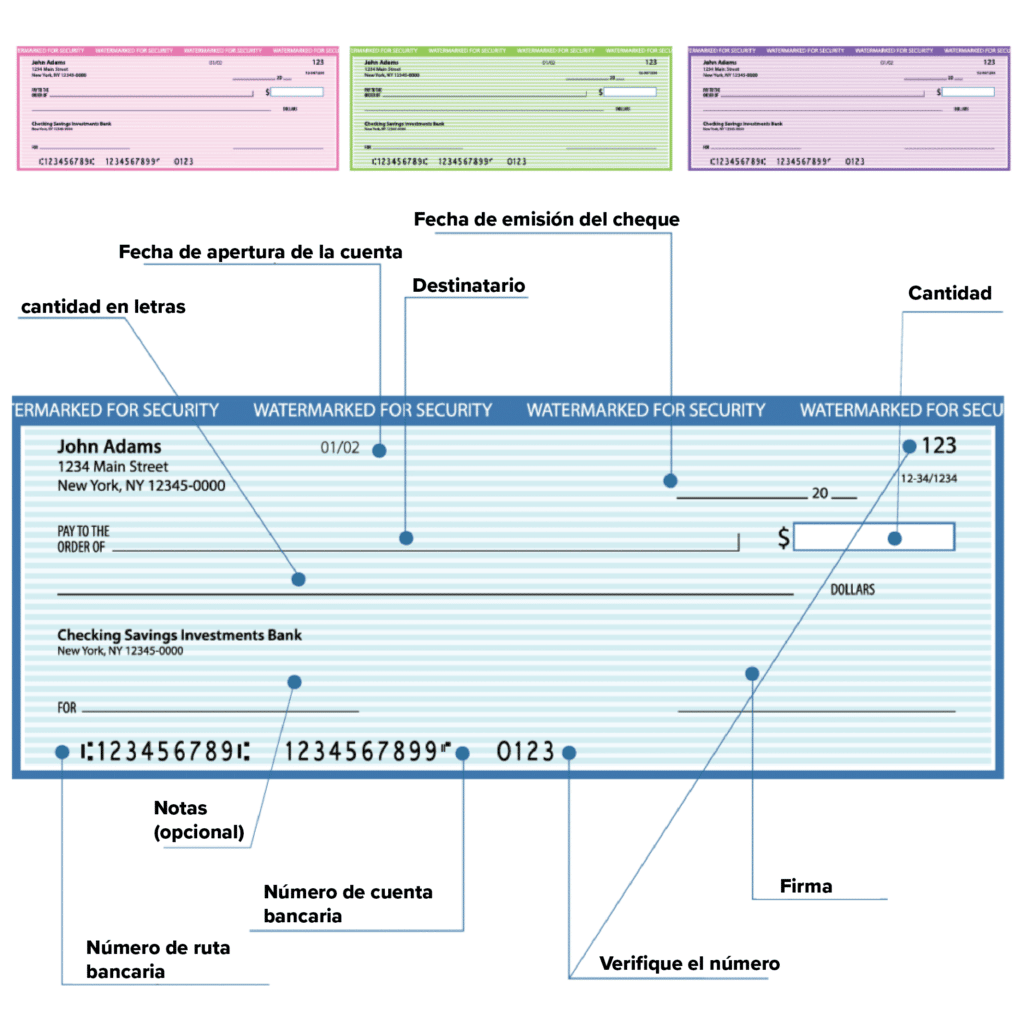

Understanding the Anatomy of a Check

The Essential Parts of a Check

A check is essentially a pre-printed form that allows you to securely transfer money from your checking account to someone else. To ensure your check is legible and accepted, it’s crucial to understand the different parts of the check and their purpose.

Here’s a breakdown of the essential components of a check:

- Your Name and Address: This information is printed in the top left corner of the check and helps identify the issuer of the check (that’s you!).

- Check Number: Located at the top right corner, this unique number helps track the specific check.

- Date: The date you write on the check serves as a record of when the transaction took place. Write the month, day, and year in the designated space.

- Pay to the Order of: This area is where you write the name of the recipient or payee who will receive the funds. Ensure accuracy as any errors could hinder the payment process.

- Amount in Numerals: In the box provided, write the amount of money you’re paying in numerals. This is usually a two-digit number with a decimal point. This number should match the written amount below.

- Amount in Words: Below the numerical amount box, write the amount in words. Pay careful attention to spelling and grammar. For example, write “One hundred and fifty dollars” for $150.

- Memo Line: This is an optional section that allows you to provide a brief description of the payment. For instance, you could write “Rent” or “Utilities.” This helps both you and the recipient keep track of the payment purpose.

- Your Signature: Sign your name in the lower right corner of the check. Your signature verifies that the payment is authorized and from your account.

- Check Routing Number and Account Number: Printed at the bottom of the check, this information is used by the bank to identify your account and process the payment.

Writing a Check in English: Step-by-Step

Image: nl.dreamstime.com

Step 1: Gathering Information

Before you start writing the check, gather the necessary information:

- Recipient Name: Make sure you have the correct name of the person or organization you are paying. Double-check for spelling errors.

- Amount: Determine the exact amount of money you want to pay.

- Date: Note the current date when writing the check to ensure accuracy.

- Memo (Optional): If needed, formulate a brief description of the payment for easy reference.

Step 2: Filling out the Check

Now that you have the necessary information, let’s fill out the check step by step:

- Date: Write the current date in the top right-hand corner of the check. Use the format “Month, Day, Year.” For example, “May 15, 2024.”

- Pay to the Order of: Write the recipient’s name clearly and legibly in this space. Make sure there are no spelling errors.

- Amount in Numerals: Enter the amount of the payment as a numeral in the designated box. Remember to use a decimal point.

- Amount in Words: Write out the amount of the check in words below the numeral box, starting with the dollar amount followed by “and” and the cents amount. For example, “$150.50” would be written as “One hundred and fifty and 50/100.”

- Memo Line (Optional): If you need to add a brief description of the payment, write it in the memo line.

- Your Signature: Sign your name in the designated space beneath the memo line. Make sure your signature is clear and legible.

Step 3: Double-Checking for Errors

Once you’ve filled out the check, it’s essential to double-check for any errors:

- Accuracy: Ensure that you’ve correctly written the recipient’s name and the amount of money.

- Legibility: Make sure your handwriting is clear and easy to read. Avoid using abbreviations or slang terms.

- Spelling: Carefully review the spelling of all words on the check, especially in the payee’s name and the amount in words.

- Amount Match: Verify that the amount written in numerals matches the amount written in words. A discrepancy between these amounts could lead to delays or rejection of the check.

Essential Tips and Expert Advice

Tips for Writing a Check Effectively

Here are some expert tips to ensure you write a check effectively:

- Use Blue or Black Ink: Avoid using red or green ink as it can be harder to read by automated systems.

- Write on the Check Line: Stick to the designated lines when writing the amount in words to ensure it’s clearly legible and easily processed by the bank.

- Keep a Record: Maintain a record of all the checks you write, including the date, payee, amount, and memo. This helps you track your finances and catch any errors.

- Use a Check Register: A check register is a useful tool for recording all your check-related transactions. Keep a running balance of your account to avoid overspending.

Expert Advice for Check Writing

In today’s digital age, checks might seem outdated. However, they’re still useful in certain situations, like paying for rent, utilities, or for vendors who don’t accept online payments. So, it’s crucial to understand how to write a check properly.

If you’re ever unsure about any aspect of writing a check, consult with your bank or financial advisor. They can provide further guidance and clarify any doubts you may have.

Frequently Asked Questions

Here are some frequently asked questions about writing a check in English:

Q: What if I make a mistake while writing a check?

A: If you make a mistake, it’s best to void the check by writing “VOID” across the face of the check. Then, write a new check with the correct information.

Q: Can I write a check for less than a dollar?

A: Yes, you can write a check for less than a dollar. However, the bank will typically round it down to the nearest dollar.

Q: What should I do if I lose a check?

A: If you lose a check, immediately contact your bank to report it. They can help you stop payment on the check, preventing anyone else from using it.

Q: Can I use a check for online transactions?

A: No, you cannot use a check for online transactions. You’ll need to use a debit card, credit card, or other electronic payment method for online purchases.

Como Escribir Un Cheque En Inglés

Conclusion

Writing a check in English is a valuable skill that can come in handy in various situations. By following the steps outlined in this guide, you can confidently write checks and avoid any misunderstandings.

Remember, it’s always a good idea to review your check before handing it over, ensuring all the information is accurate and legible. Are you interested in learning more about financial literacy and other aspects of personal finance? Let us know in the comments below!