Have you ever felt overwhelmed by the seemingly random fluctuations of stock prices? Do you wish you could decipher the hidden patterns that lie beneath the surface of financial markets? You’re not alone. Many aspiring investors struggle to interpret the complex language of price charts, missing out on potentially lucrative opportunities. But what if I told you that with the right tools and understanding, you could unlock the secrets of these charts and gain a powerful edge in your trading journey? This guide will introduce you to the world of bar-by-bar price chart analysis, empowering you to read the whispers of the market and make informed decisions.

Image: whatstudy.net

Imagine looking at a complex jigsaw puzzle with hundreds of pieces. Each individual piece might seem meaningless on its own, but when you start connecting them, a fascinating picture emerges. Price charts are no different. They contain a wealth of information, and understanding the nuances of how the price moves can provide valuable insights into market sentiment, support and resistance levels, and potential future trends. This guide will provide a comprehensive overview of bar-by-bar analysis, from the basic building blocks to practical strategies you can use to navigate the world of trading with confidence.

The Foundation of Bar-by-Bar Price Chart Analysis

It all starts with the building blocks: understanding individual bars. Understanding the individual bars is the cornerstone of bar-by-bar analysis. Each bar on a price chart represents a specific time period, such as 1 minute, 5 minutes, or even daily, and encapsulates crucial information about price movements.

Here’s a breakdown of what you need to know:

- Open: The price at which the bar begins.

- High: The highest price reached during the bar’s time frame.

- Low: The lowest price reached during the bar’s time frame.

- Close: The price at which the bar ends.

The direction of a bar indicates whether the price has moved up (green) or down (red) during that specific time period. By analyzing the relationship between the open, high, low, and close, you can identify specific patterns that reveal market momentum and trader psychology.

Deciphering the Language of Bar Patterns

Once you understand the basics, you can begin to decipher the language of bar patterns. These visual representations within a chart can reveal valuable information about market trends and potential price movements.

Here are some common bar patterns to watch out for:

-

Doji: This peculiar pattern occurs when the open and close prices are practically the same, with a very small range between the high and low. Dojis suggest a battleground between buyers and sellers, resulting in a stalemate. You can interpret this as a sign of indecision in the market, hinting at potential reversals.

-

Hammer and Hanging Man: These patterns are characterized by a small body and a long lower (hammer) or upper (hanging man) shadow. Hammers indicate a bullish reversal, while hanging men suggest a bearish reversal. They indicate a strong rejection of the prevailing trend, potentially marking an inflection point.

-

Engulfing Pattern: This powerful pattern occurs when one bar completely engulfs the previous bar. A bullish engulfing pattern appears when the current bar’s open is below the previous bar’s close, and its close surpasses the previous bar’s open. Conversely, a bearish engulfing pattern emerges when the current bar’s open is above the previous bar’s close and its close falls below the previous bar’s open. These patterns strongly suggest a trend reversal.

-

Inside Bar: This pattern occurs when the current bar’s high and low are contained within the previous bar’s high and low. Inside bars represent consolidation and suggest a period of market indecision, but they can act as potential breakout points.

Finding Support and Resistance Levels

As you delve deeper into bar-by-bar analysis, you’ll discover the importance of identifying support and resistance levels. These are price levels where the market tends to bounce off, offering valuable clues about potential price direction.

-

Support Levels: These are price levels where buying pressure is stronger than selling pressure, making it a likely point where the price will find support and bounce back. You can identify support levels by noticing areas where the price has repeatedly bounced back from.

-

Resistance Levels: These are price levels where selling pressure is stronger than buying pressure, making it a likely point where the price will stall and potentially reverse. You can identify resistance levels by noticing areas where the price has repeatedly failed to break through.

By utilizing support and resistance levels, you can gain a better understanding of potential price movements and create informed trading strategies.

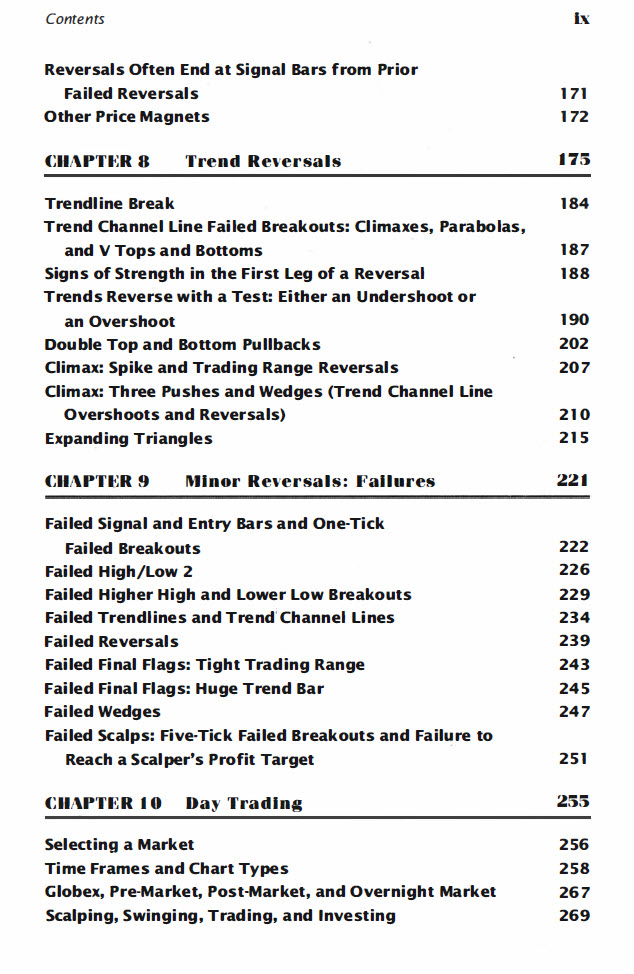

Image: diendantailieu.com

Spotting Trends and Identifying Momentum

Identifying trends and momentum is crucial in your journey to master bar-by-bar analysis. Trends are the overall direction of price movement, categorized as uptrends (rising prices), downtrends (falling prices) or sideways (ranging movements). However, trends are not always straightforward and can shift subtly. This is where identifying momentum comes into play.

- Momentum: Refers to the strength and speed of price movements. Strong momentum is often accompanied by large bars, indicating a surge in buying or selling pressure. This information can help you anticipate the direction of the trend and when a potential shift might occur.

You can use this knowledge to ride profitable trends and avoid getting caught in fading trends.

The Power of Volume

Volume, the number of shares traded during a specific period, provides further insights into market activity.

-

High volume: Signals strong buying or selling pressure, indicating a change in trend is likely. A surge in volume accompanying a breakout of a trendline often signifies confirmed momentum.

-

Low volume: Indicates a lack of interest in the market, suggesting a sluggish or potentially unreliable trend. This can be an indication of a trading range or a trend that might soon reverse.

By analyzing volume alongside bar patterns, you can gain a more complete picture of market sentiment and make better trading decisions.

The Art of Backtesting and Practice

The only way to truly master the concept of bar-by-bar analysis is through practice. You can use historical data to backtest your trading strategies and analyze how well they would have performed in the past. This is like playing a game of chess with a time machine—it allows you to experiment with different strategies and observe how they would have played out in real-world scenarios.

Here’s how you can practice:

-

Select a timeframe: Choose a specific time frame like 1-hour, 4-hour, or daily bars for your practice.

-

Focus on a specific asset: Select an asset like a stock, commodity, or currency you are interested in.

-

Identify patterns: Look for common bar patterns and support/resistance levels.

-

Simulate trades: Imagine entering and exiting trades based on your observations.

-

Evaluate your results: Analyze your hypothetical trades and figure out if your strategy would have been successful.

By practicing these steps consistently, you’ll refine your understanding of bar-by-bar analysis and become more comfortable making trading decisions.

Practical Tips for Your Trading Journey

Remember that bar-by-bar analysis is a powerful tool but not a magical solution. It’s important to combine this analysis with other technical indicators and fundamental analysis for a holistic approach to trading.

Here are some practical tips to set you up for success:

-

Start simple: Don’t get overwhelmed by trying to analyze too many patterns at once. Start with a few basic patterns and gradually expand your knowledge.

-

Look for confirmation: Don’t rely solely on bar patterns. Use other technical indicators and volume to confirm your assumptions.

-

Manage your risk: Even the best traders make mistakes. Always use stop-loss orders to limit potential losses and manage your risk effectively.

-

Stay patient: Trading is a marathon, not a sprint. Be patient, analyze the market carefully, and wait for the right opportunities.

Reading Price Charts Bar By Bar Pdf Free Download

Conclusion

The journey to mastering bar-by-bar price chart analysis is a continuous process of learning and refinement. Understanding the patterns, support and resistance, volume, and trends can empower you to make informed decisions. By practicing consistently and following these tips, you can unlock the secrets of price charts and embark on a successful journey of financial growth.

The knowledge you’ve gained today is just the beginning. Keep exploring, keep learning, and remember that the only limits to your success are the ones you set for yourself.