Imagine this: You’re working diligently, pouring your heart and soul into your job. You’re putting in those extra hours, going above and beyond to meet deadlines and exceed expectations. But when you look at your paycheck, you feel a pang of disappointment. The extra effort seems to have yielded minimal reward. The question arises: Is that extra work really paying off? The truth is, in many instances, those extra hours should be reflected in a higher paycheck thanks to overtime pay regulations.

Image: www.chegg.com

Understanding overtime pay is crucial for any worker, whether you’re a seasoned professional or just starting your career. It’s your right, and knowing your rights empowers you to secure the financial compensation you deserve. This guide delves into the intricacies of overtime pay, equipping you with the knowledge you need to maximize your earnings and ensure you’re fairly compensated for your hard work.

Decoding Overtime Pay: What It Is and Why It Matters

Overtime pay is a premium wage that is paid to employees who work more than a certain number of hours in a workweek. This extra pay is typically calculated at a rate higher than the employee’s regular hourly rate. The concept of overtime pay is rooted in labor laws that were established to protect workers from exploitation and to ensure they are adequately compensated for their time and effort.

The Fair Labor Standards Act (FLSA) is the federal law that dictates overtime pay regulations in the United States. It mandates that most employees are entitled to overtime pay at a rate of one and a half times their regular hourly rate for any hours worked over 40 in a workweek. This means that if you earn $15 per hour and you work 45 hours in a week, you would earn an extra 5 hours of pay at $22.50 per hour ($15 x 1.5). This additional income can make a substantial difference, especially for those who consistently work overtime.

Understanding the Nitty-Gritty: Who is Eligible for Overtime Pay?

Not all workers are automatically entitled to overtime pay. The FLSA exempts certain occupations, including:

- Executive Employees: Individuals with significant managerial responsibilities and who are authorized to hire and fire employees.

- Administrative Employees: Workers who primarily perform office or non-manual work that is directly related to the management of the business.

- Professional Employees: Individuals who carry out work requiring advanced knowledge and who utilize their judgment and creativity.

- Outside Sales Employees: Workers who sell goods or services outside the employer’s place of business and whose primary duty is making sales.

- Computer Employees: Individuals who are paid on a salary basis and perform highly specialized computer-related work.

It’s crucial to note that these exemptions are not absolute. Specific criteria must be met for an employee to qualify for an exemption. For instance, an employee who is classified as an executive must have a primary duty of managing the company and must not be under the supervision of others in their daily work. If your employer incorrectly classifies you as exempt when you should be eligible for overtime pay, you may have grounds for legal action.

Overtime Pay and Its Impact on Your Finances: A Closer Look

Overtime pay has a direct and tangible impact on your finances. It can significantly boost your earnings and enhance your financial security. Here’s how:

1. Increased Income: The most obvious benefit of overtime pay is the additional income it provides. This extra money can help you cover essential expenses, pay off debts, or save for your future.

2. Budget Flexibility: Overtime pay offers you greater budget flexibility. You can use this extra income to make larger purchases, take vacations, or invest in your personal growth.

3. Financial Stability: Regular overtime pay can contribute to your overall financial stability. By generating higher earnings, you can build a stronger financial foundation and safeguard yourself against unexpected financial emergencies.

Image: brookszanetta.blogspot.com

Getting Your Due: Calculating and Negotiating Overtime Pay

Calculating overtime pay is relatively straightforward. As previously mentioned, most hourly employees are entitled to overtime pay at 1.5 times their regular hourly rate for hours worked over 40 in a week. Here’s a simple formula to help you:

Overtime Pay = (Regular Hourly Rate x 1.5) x Number of Overtime Hours

For instance, if your regular hourly rate is $15 and you work 45 hours in a week, your overtime pay would be calculated as follows:

Overtime Pay = ($15 x 1.5) x 5 hours = $112.50

That means you’d receive $112.50 in overtime pay for the extra 5 hours you worked.

In some cases, you may be able to negotiate a higher overtime pay rate with your employer. Depending on your role, your industry, and your employer’s policies, you may be able to secure a rate that exceeds the standard 1.5 times your regular hourly rate. It’s important to research current market rates for workers in similar roles and to determine what a fair and competitive overtime rate would be.

Protecting Your Overtime Pay: Be Aware of Potential Pitfalls

While overtime pay offers numerous benefits, there are certain pitfalls you need to be aware of. Employers may attempt to circumvent overtime pay regulations, so here are some common practices to be watchful for:

-

Misclassifying Employees as Exempt: Employers may attempt to misclassify employees as exempt, even though they are eligible for overtime pay. It’s crucial to understand your job duties and ensure you are not being misclassified.

-

Pressuring Employees to Waive Overtime Pay: Some employers may try to pressure employees to give up their right to overtime pay. Know that you have the right to receive overtime pay and that it is illegal for your employer to coerce you into giving it up.

-

Rounding Down Hours: Employers may engage in tactics like rounding down hours worked. Be mindful of how hours are recorded and ensure all time worked is accurately reflected on your timesheets.

-

Using Unpaid Time Off to Avoid Overtime Pay: Some employers may encourage employees to use unpaid time off to avoid paying overtime. You should only use unpaid time off when you are truly unavailable to work.

It’s essential to be vigilant and knowledgeable about these potential tactics. If you suspect your employer is engaging in any of these practices, it’s advisable to consult with the Department of Labor or an employment attorney.

Navigating the Work-Life Balance: Understanding the Overtime Pay Conundrum

Overtime pay can be a financial blessing, but it also poses a potential challenge to maintaining a healthy work-life balance. While overtime work can boost your income, it can also lead to burnout, stress, and diminishing returns.

Here are some crucial considerations:

-

Prioritize Your Health: Working excessive overtime can negatively impact your physical and mental health. It’s essential to set boundaries and ensure you’re getting enough rest and relaxation.

-

Communicate Effectively: Have open communication with your employer about your workload and your capacity to handle overtime. If you’re feeling overwhelmed, don’t hesitate to express your concerns.

-

Seek Support Systems: Network with coworkers, friends, and family to create a strong support system. Lean on these individuals for emotional support and guidance when you’re feeling the weight of overtime work.

**It’s vital to recognize that overtime should be a conscious choice, not a forced obligation. If you are working too much overtime, consider seeking alternative work arrangements or a different position. Remember, your well-being is paramount.

Expert Insights to Empower Your Earnings: Strategies for Optimizing Overtime Pay

1. Negotiate Your Rate: Don’t simply accept the standard 1.5 times your regular rate. Research market rates for comparable roles and negotiate a rate that reflects your experience and skills.

2. Plan Your Overtime: Determine the amount of overtime you are comfortable with and communicate this to your employer. Schedule overtime hours thoughtfully, factoring in your personal commitments and responsibilities.

3. Track Your Hours Meticulously: Accurate recordkeeping is crucial. Maintain detailed time sheets and track each hour of work, including overtime. This protects you if there are any disputes or questions about your overtime pay.

4. Know Your Rights: Familiarize yourself with the FLSA guidelines, and consult with an employment attorney if you have any questions or concerns about your overtime pay.

5. Seek Growth Opportunities: Explore opportunities for professional development and advancement. Increased skills and expertise can lead to higher pay and potentially reduce the need for overtime.

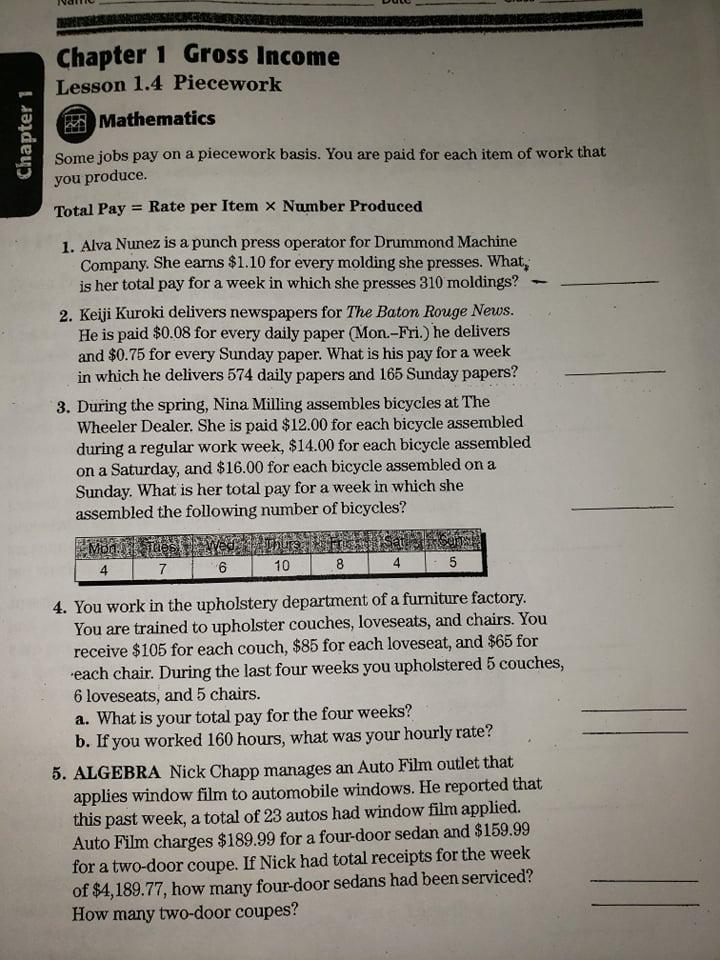

Chapter 1 Gross Income Lesson 1.2 Overtime Pay Answer Key

Empowering Yourself for a Brighter Financial Future

Overtime pay can be a significant financial boon, but it’s important to approach it with a balanced perspective. Knowing your rights, maximizing your earnings, and protecting your well-being are critical aspects of managing overtime effectively. Your time and work are valuable assets, and understanding how to leverage overtime pay strategically can lead to a more secure and fulfilling financial future. Don’t simply work more; work smarter, and reap the rewards of your hard work.