Have you ever found yourself staring at a Royal Bank of Canada (RBC) ATM, wondering what exactly a “transit code” is and why it matters? You’re not alone. This seemingly mysterious code plays a crucial role in the smooth flow of money within Canada’s banking system. But understanding its significance can feel like navigating a maze of financial jargon. This article aims to unravel the mystery, providing a clear and comprehensive guide to the Royal Bank of Canada transit code, its purpose, and its importance in your everyday banking experience.

Image: banks-canada.com

Whether you’re a seasoned bank user or just starting out, comprehending the transit code is essential for confidently managing your finances. This article will demystify this seemingly complex element of banking, equipping you with the knowledge to make informed decisions about your funds and ensuring a seamless experience when dealing with financial transactions.

What is a Transit Code?

Understanding the Fundamentals

The transit code, often referred to as the “routing number” or “institution number,” is a unique, five-digit number assigned to every financial institution in Canada. It acts as a vital identifier, informing the banking system which specific bank or credit union an account belongs to. Think of it as the postal code for your money, ensuring it reaches the right destination.

Specificity Matters

It’s important to understand that the transit code is not just specific to the bank itself; it also distinguishes between separate branches of the same bank. This means that even within RBC, different branches have their own distinct transit codes, further enhancing the level of accuracy in the financial network. This ensures that your money finds its way to the precise location it needs to be within the bank.

Image: voorichardhoward.blogspot.com

The Royal Bank of Canada (RBC) Transit Code

Royal Bank of Canada, a prominent financial institution in Canada with a vast network of branches, employs a unique transit code system. Every RBC branch has a specific transit code assigned to it, allowing for precise identification within the Canadian banking network.

Finding Your Local RBC Transit Code

Locating the transit code for the specific RBC branch you need to use is remarkably simple. Here are a few ways to accomplish this task:

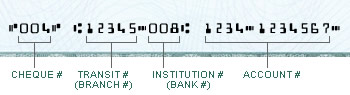

- Check your RBC Cheque: The transit code is usually printed at the top or bottom of your RBC cheques, making it easily identifiable.

- Visit the RBC Website: RBC’s online platform provides access to a branch locator tool. Simply enter your city and province to find the relevant branch details, including the transit code.

- Contact RBC Customer Service: If you have difficulty finding the transit code on your own, RBC’s dedicated customer service representatives are available to assist you by phone or online.

The Role of Transit Codes in Banking Transactions

Interbank Transfers

Transit codes are essential for seamless interbank transfers. When you initiate a money transfer to another bank, the transit code ensures that the transaction is directed to the correct recipient’s institution. This makes the banking system efficient, allowing for smooth financial flows between institutions.

Electronic Funds Transfers (EFTs)

EFTs, a common form of digital payment, rely heavily on transit codes. When sending money electronically, the transit code tells the banking system the exact location of the recipient’s account within the receiving bank, ensuring accurate delivery of funds.

Bill Payments

When paying bills, the transit code for the financial institution that processes the bill plays a pivotal role. It ensures that your payment reaches the intended recipient, whether it’s a utility company, a credit card issuer, or any other service provider.

Why Knowing the Transit Code is Crucial

Safeguarding Your Finances

The transit code is a crucial element in protecting your hard-earned money. By ensuring your funds go exactly where they need to, the transit code minimises the risk of errors or misdirection. This safeguarding feature is essential for maintaining financial stability and peace of mind.

Avoiding Delays and Complications

Omitting the transit code or using the wrong one can lead to delays in your transactions and even incorrect account credits. This can result in inconvenience and potential financial strain. Therefore, consistently using the correct transit code is crucial for smooth and hassle-free banking operations.

Streamlining Financial Management

Understanding the transit code empowers you to manage your finances more efficiently. By knowing this key piece of information, you can confidently initiate payments, transfers, and other financial transactions, simplifying the process and reducing the likelihood of errors.

The Future of Transit Codes

As digital technologies continue to shape the financial landscape, the role of transit codes is evolving. With the increasing popularity of mobile payments and digital banking, the accuracy and efficiency of transit codes become even more paramount. Financial institutions are constantly working to enhance their systems, ensuring that the transit code remains a vital pillar in securing and streamlining financial transactions.

Royal Bank Of Canada Transit Code

Conclusion

The Royal Bank of Canada transit code is a fundamental part of the banking ecosystem, playing a crucial role in ensuring the accuracy and security of your financial transactions. By understanding its purpose, locating it easily, and applying it correctly, you can confidently manage your finances, avoid potential delays, and ensure your hard-earned money reaches its intended destination. The value of knowing the transit code lies in its capacity to streamline financial management, protect your funds, and enhance your overall banking experience. So next time you encounter this seemingly simple code, remember its vital role in the intricate network of Canadian banking.