Imagine this: you’ve been with your insurance company for years, faithfully paying your premiums, and feeling secure in the knowledge that you’re protected. But then, life changes. Perhaps you’ve bought a new car, found a new job with better benefits, or simply discovered a better deal elsewhere. Now, you find yourself wanting to switch insurance providers and it feels like a daunting task. The question arises: how do you cancel your existing policy without any hassle?

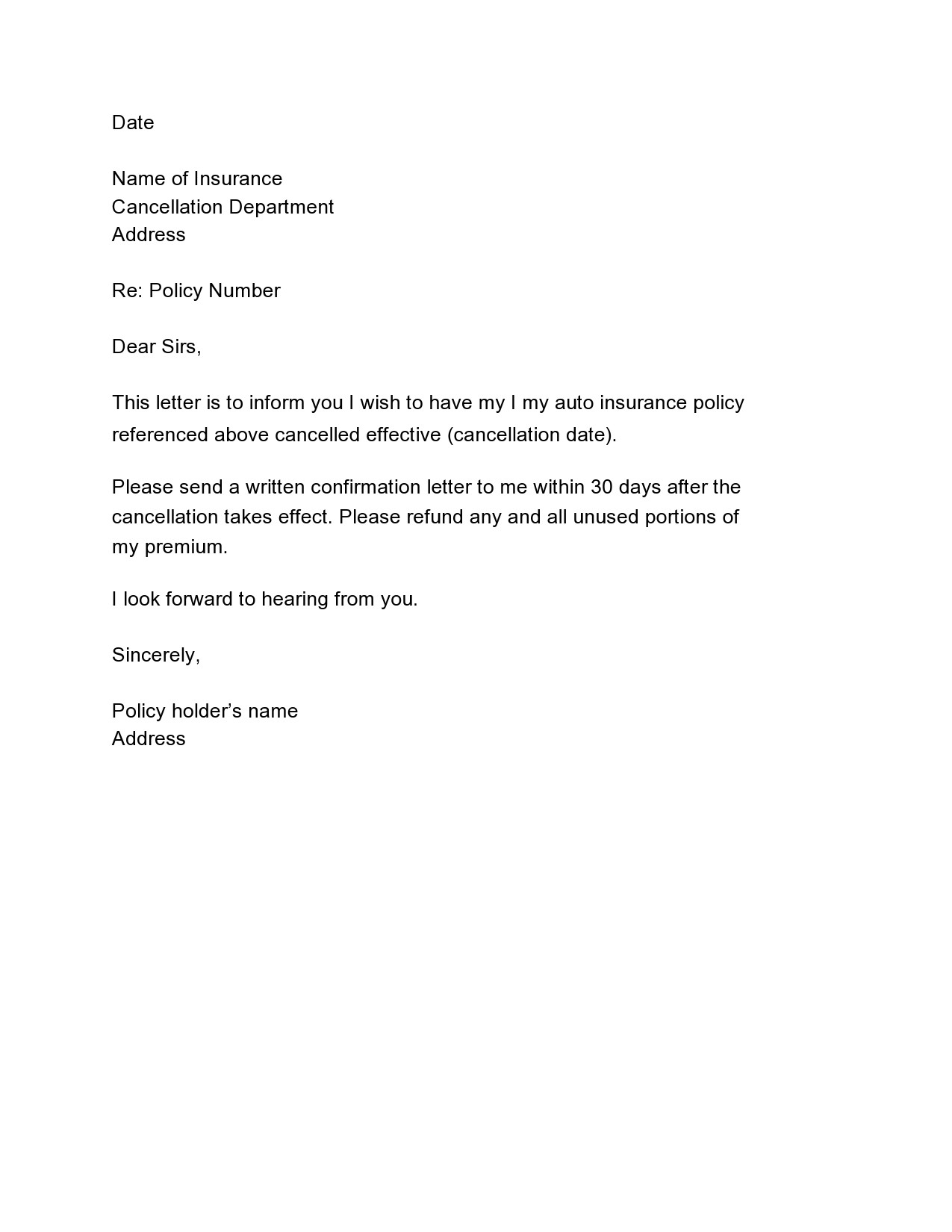

Image: templatelab.com

This is where a carefully crafted cancellation letter comes into play. A well-written letter can save you time, money, and emotional stress. It can prevent misunderstandings, ensure you receive your refund (if applicable), and even safeguard you from potential future claims. So, let’s dive into the world of effective insurance cancellation letters and discover how to navigate this process with ease.

A Comprehensive Guide to Writing Your Cancellation Letter

Before we delve into the sample letter, let’s understand the key components that make a cancellation letter effective.

- Be Clear and Concise: Lay out your intentions in straightforward language. There’s no need for elaborate explanations or emotional appeals.

- Include Essential Information: Your policy number, name, contact information, and cancellation date are crucial.

- State Your Reason for Cancellation (Optional): While not always necessary, you can include a brief explanation if you’d like. This could be a switch to a different provider, a change in your circumstances, or simply a desire for a better deal.

- Acknowledge any Outstanding Payments: If you have any pending payments, make sure to address them clearly.

- Request Confirmation: End your letter by politely requesting confirmation of cancellation. This helps ensure that your request has been received and processed.

Example Cancellation Letter:

Here’s a sample letter you can use as a starting point:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Cancellation of Policy Number [Policy Number]

Dear [Insurance Company Representative Name],

This letter formally requests the cancellation of my insurance policy, [Policy Number], effective [Date].

Please confirm the cancellation of this policy in writing and provide any necessary instructions for returning any relevant materials.

Sincerely,

[Your Signature]

[Your Typed Name]

Further Tips to Ensure a Smooth Cancellation:

- Review Your Policy: Carefully examine your policy for details on cancellation procedures and any applicable fees. Ensure you understand the process and the potential implications of cancellation.

- Contact Your Insurance Company: It’s always recommended to contact your insurer verbally and confirm your intent to cancel, especially if you have a complex policy. This helps initiate the cancellation process and address any immediate concerns.

- Keep Records: Retain copies of all correspondence, including your cancellation letter, confirmation notices, and other relevant documents.

- Check for Outstanding Payments: Before finalizing the cancellation, confirm whether there are any pending premiums or other dues. Make sure to settle any outstanding payments to avoid future complications.

- Understand the Cancellation Period: Be aware of the cancellation period outlined in your policy. Cancellation may be effective immediately, or it could take some time to process, depending on your insurer and insurance type.

- Consider a Replacement Plan: If you are switching providers, ensure that your new policy is in place before you cancel your existing one. This prevents any gaps in coverage and allows for a smooth transition.

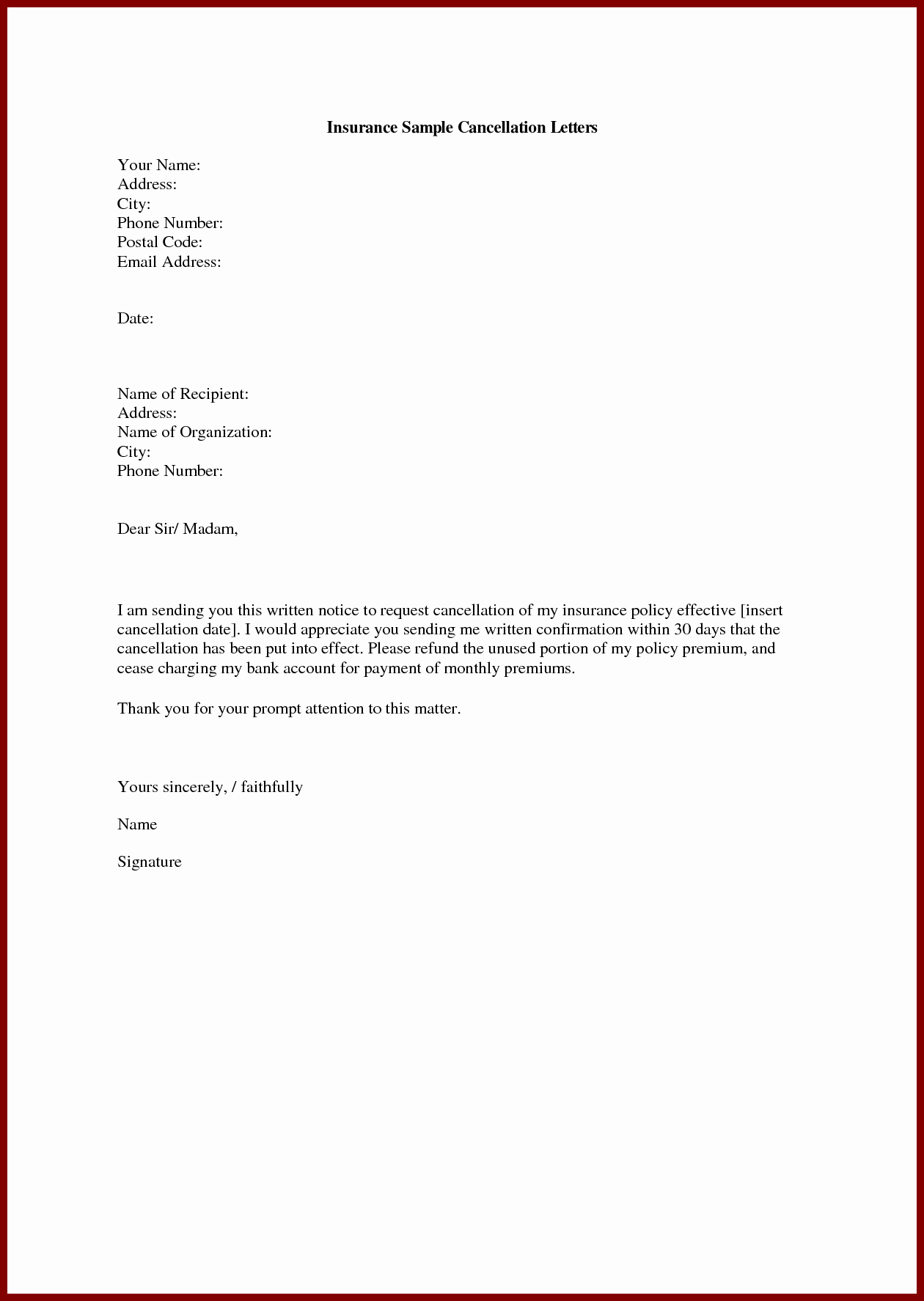

Image: simpleartifact.com

Example Letter To Cancel Insurance Policy

Final Thoughts

Navigating the world of insurance cancellation doesn’t have to be an intimidating experience. By understanding the process, composing a clear and concise letter, and following these tips, you can ensure a smooth and effortless transition from your current insurer. Remember, taking control of your insurance needs empowers you to make informed decisions and secure the best possible coverage for you and your loved ones.

Don’t be afraid to reach out to your insurance company with any questions or concerns you might have. And remember, a well-written cancellation letter is just the first step in securing your financial well-being and taking charge of your insurance journey.